rhode island tax table

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. 2019 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Nesi Takes On Tax Policy Ri Future

2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

. More about the Rhode Island Tax Tables. Rhode Island Income Tax Rate 2022 - 2023. Rhode Island Tax Brackets for Tax Year 2021.

This form is for income earned in tax year. How to Calculate 2022 Rhode Island State Income Tax by Using State Income Tax Table. Income tax tables and.

Compare your take home after tax and estimate. Find your pretax deductions including 401K flexible account. Any income over 150550 would be.

However if Annual wages are more than 231500 Exemption is 0. Rhode Islands 2022 income tax ranges from 375 to 599. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of. Compare your take home after tax and estimate.

Find your income exemptions. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. Apply the taxable income computed in step 5 to the following.

Exemption Allowance 1000 x Number of Exemptions. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. The Rhode Island State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 Rhode Island State Tax CalculatorWe also.

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. 2022 Rhode Island Sales Tax Table. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation.

More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

Some Rhode Islanders Still Waiting On Tax Refunds

How To Set Up An Llc In Rhode Island 2022 Guide Forbes Advisor

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island State Tax Tables 2021 Us Icalculator

Fillable Online Tax State Ri Rhode Island Tax Table 2009 Tax State Ri Fax Email Print Pdffiller

Rhode Island Division Of Taxation 2019

Mckee R I Assembly Leaders Announce Plans To End Car Tax And Provide One Time Child Tax Credits The Boston Globe

Will Mississippi Join The No Income Tax Club International Liberty

Rhode Island Income Tax Brackets 2020

Map Of Rhode Island Property Tax Rates For All Towns

Free Rhode Island Tax Power Of Attorney Form Ri 2848 Pdf Eforms

Top Personal Income Tax Pit Rates In The 50 States In 2004 And 2005 Download Table

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

State Sales Tax Rates Sales Tax Institute

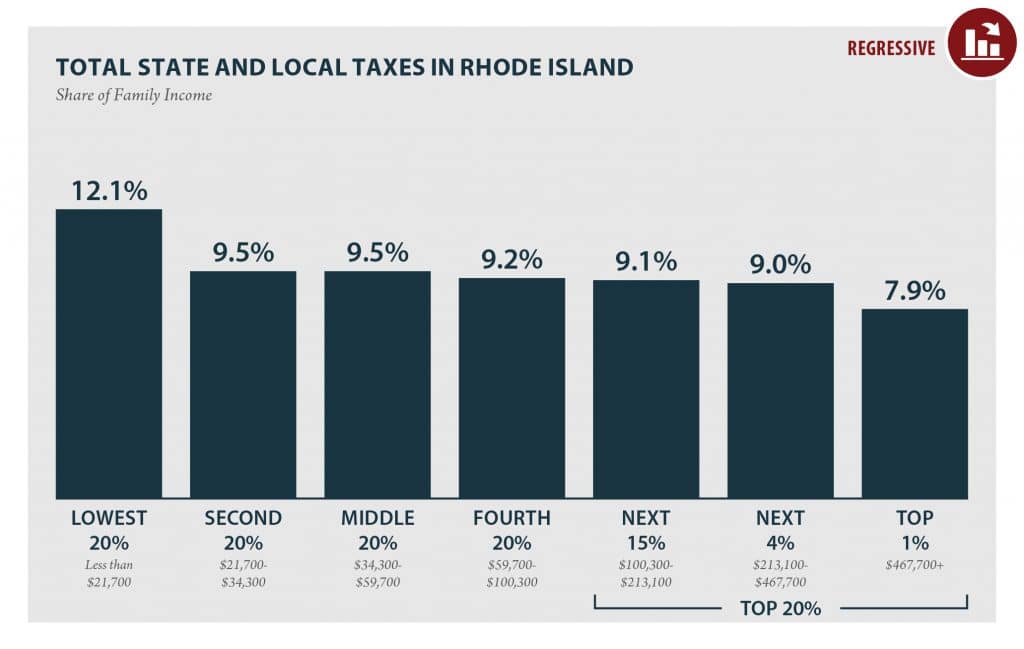

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

2014 Rhode Island Standard Of Need Economic Progress Institute